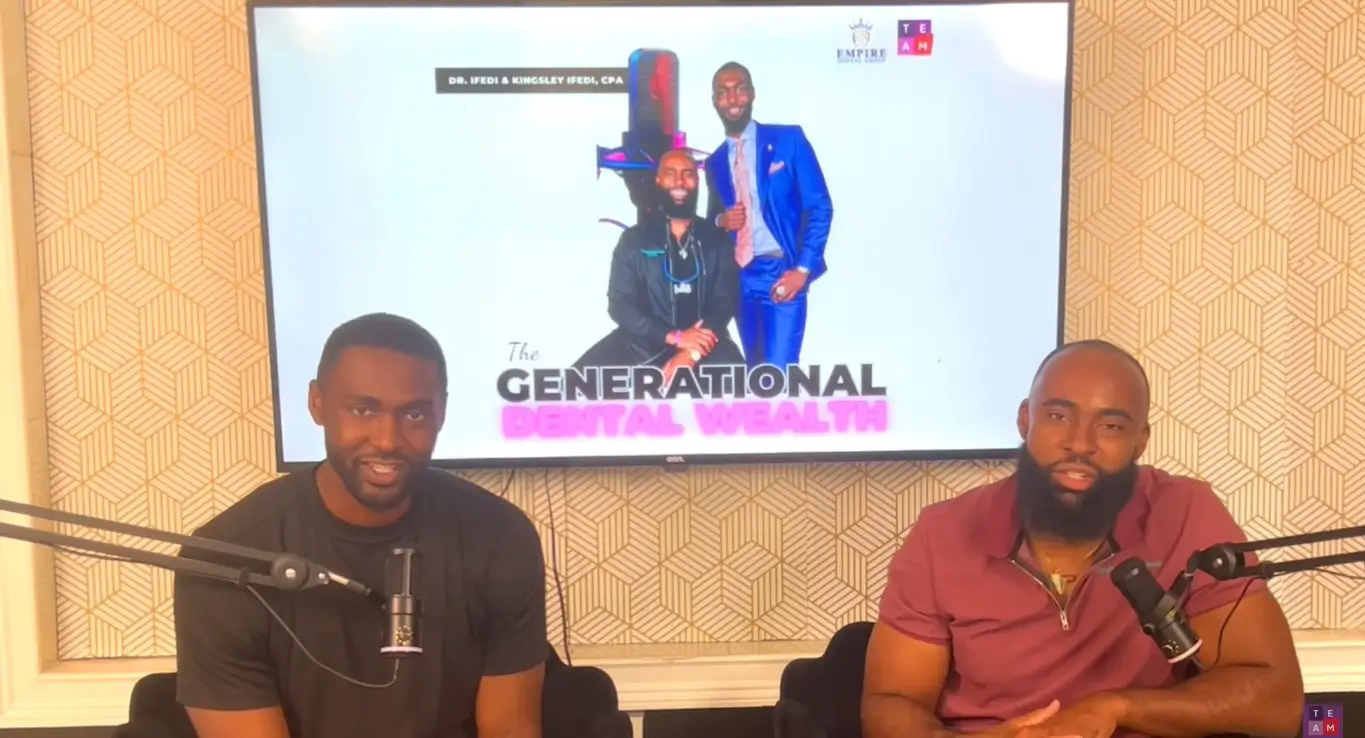

GENERATIONAL DENTAL WEALTH PODCAST S2 | EP. 30 | BLOG POST

The Surprising Financial Reality: Why Most Doctors Aren’t Millionaires

It’s a common assumption that becoming a doctor is a guaranteed path to wealth. After all, doctors spend years in education, often amassing significant student debt, with the expectation that high salaries will eventually lead to financial security and even millionaire status. However, despite the impressive income potential, not every doctor becomes a millionaire. The question is, why?

The Reality of Student Debt

One of the primary barriers to wealth accumulation for doctors is the enormous burden of student debt. Medical school is expensive, often requiring students to take out substantial loans. By the time they graduate, many doctors are facing debt in the hundreds of thousands of dollars.

While doctors may eventually earn high incomes, it can take years—sometimes decades—to pay off this debt. During this time, the interest on loans continues to accumulate, further delaying the ability to save and invest. Additionally, the focus on paying down debt can overshadow the importance of building wealth through investments and savings.

Delayed Earnings and Lifestyle Inflation

Another factor to consider is the delayed start to a doctor’s career. While their peers in other professions may start earning and saving in their early twenties, doctors typically don’t begin earning substantial incomes until they complete their residency, often in their late twenties or early thirties. This delayed entry into the workforce means less time to benefit from the power of compounding investments.

Moreover, when doctors do begin earning a higher income, many succumb to lifestyle inflation. After years of financial restraint, it can be tempting to upgrade to a more luxurious lifestyle—buying a larger home, driving a nicer car, or taking extravagant vacations. While these purchases are often seen as rewards for years of hard work, they can significantly hinder long-term wealth accumulation if not managed carefully.

Lack of Financial Education

Despite their extensive education, many doctors receive little to no training in financial management. Medical school curriculums are focused on patient care, not personal finance or business management. As a result, doctors may not fully understand how to effectively manage their money, invest for the future, or plan for retirement.

Without a solid financial education, doctors may make costly mistakes, such as poor investment choices, inadequate retirement planning, or even falling victim to financial scams. Furthermore, the demands of a medical career can leave little time for doctors to educate themselves on financial matters, leading to reliance on financial advisors who may not always have their best interests at heart.

The High Cost of Practice Management

For those doctors who choose to open their own practices, the financial challenges can be even greater. Running a medical practice involves significant overhead costs, including rent, staff salaries, insurance, and equipment. In addition, the administrative burden of managing a practice can be overwhelming, often leading to burnout and reduced earning potential.

Moreover, the healthcare industry is heavily regulated, and staying compliant with these regulations requires additional time and financial resources. All of these factors can erode a doctor’s income, making it more difficult to save and invest.

Taxes and Wealth Erosion

High incomes often come with high tax liabilities. Doctors, especially those in higher tax brackets, may see a substantial portion of their earnings go to federal, state, and local taxes. Without effective tax planning, a doctor’s income can be significantly eroded, reducing the amount available for savings and investments.

In addition to income taxes, doctors may face other financial obligations, such as malpractice insurance, which can be extremely costly. These expenses further diminish their ability to accumulate wealth.

Let’s continue to learn from inspiring dental professionals like Dr. Octavia Miller and work towards a brighter and more inclusive future for the dental profession.

Conclusion: The Path to Financial Success for Doctors

While the barriers to becoming a millionaire as a doctor are significant, they are not insurmountable. The key to financial success lies in early and effective financial planning, disciplined saving and investing, and a commitment to ongoing financial education. Doctors who take control of their finances, manage their debt wisely, and make informed investment decisions are far more likely to achieve the financial success that their years of education and hard work should afford them.

Ultimately, the path to becoming a millionaire as a doctor requires more than just earning a high income. It requires a strategic approach to managing money, making sound financial decisions, and planning for the future. By overcoming the challenges discussed above, doctors can build the wealth they deserve and enjoy the financial freedom that comes with it.

“The Generational Dental Wealth Podcast” is your go-to resource for dental professionals and entrepreneurs looking to build, sustain, and transfer wealth across generations. Hosted by industry experts, this podcast delves into financial strategies, business growth, and legacy planning, all tailored to the unique needs of the dental community. Whether you’re a seasoned dentist or just starting out, each episode offers actionable insights to help you secure a prosperous future for yourself and your family.

The Surprising Financial Reality: Why Most Doctors Aren’t Millionaires